It’s National Financial Awareness Day!

It’s so important to build strong relationships with our local businesses. We are eager to speak about relevant topics catered to mothers and families looking for the best resources within the Broward Community. We love talking about the complex, touchy, taboo subjects that parents often have a hard time understanding and talking about because they didn’t have the chance and opportunity from their parents to learn about. We are all about the growth and development of our child for overall life skills. We chatted with, Cheryl Lumpkin in the business and Marketing department with Sun Credit Union to learn about all the programs offered. Sun Credit Union has been a vibrant part of the community since 1946. Sun Credit Union youth accounts are designed to help parents and children learn the importance of financial responsibility.

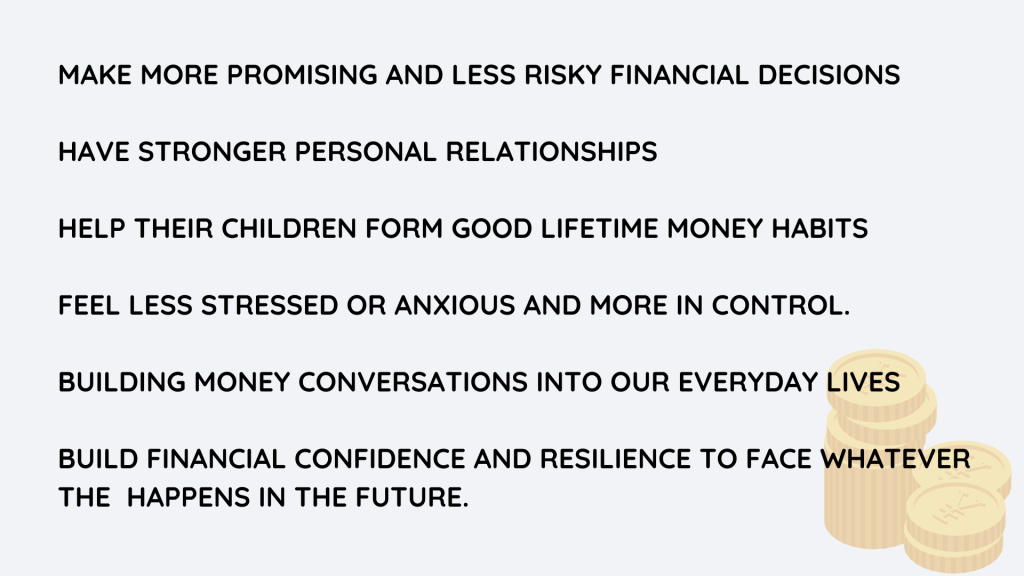

Money and financial Literacy research shows families that discuss topics regarding money are more likely to:

For National Financial Awareness day it’s the perfect time to break the stigma. If it is avoided it contributes to unsustainable stress levels at work and home, but change is possible. Working alongside the team at Sun Credit Union, we dived into understanding the different programs they can offer families during our interview to help improve thier financial literacy and how we can encourage families to start these conversations at home.

For National Financial Awareness day it’s the perfect time to break the stigma. If it is avoided it contributes to unsustainable stress levels at work and home, but change is possible. Working alongside the team at Sun Credit Union, we dived into understanding the different programs they can offer families during our interview to help improve thier financial literacy and how we can encourage families to start these conversations at home.

It’s so easy to open an account and my favorite part is that you an even start your child off at birth! How cool is that? You can come into one of the locations whether it be the Hollywood location or the Pembroke Pines location and sit down with a member services representative. If you come prepared with your child’s social security card and a copy of your ID, opening a youth account takes no more than 15-20 mins. Once the account is opened, it can be monitored and utilized through an online banking services. You can access your child’s account using a mobile app or website to see their balances, and transfer funds all from the comfort of your own home.

It’s so easy to open an account and my favorite part is that you an even start your child off at birth! How cool is that? You can come into one of the locations whether it be the Hollywood location or the Pembroke Pines location and sit down with a member services representative. If you come prepared with your child’s social security card and a copy of your ID, opening a youth account takes no more than 15-20 mins. Once the account is opened, it can be monitored and utilized through an online banking services. You can access your child’s account using a mobile app or website to see their balances, and transfer funds all from the comfort of your own home.

Here is a brief overview of Sun Credit Union’s Youth Accounts.

Newbee | Birth – Age 3 | It’s never too early to start saving! Savings account with quarterly dividends on balances over $100.00. Automatically converts to a Pelican Pennie account at age 4.

Pelican Pennie | Ages 4 – 12 | Exciting, interactive program designed to help kids learn the value of being penny-wise. Kids earn rewards for saving their pennies!

Smart Start | Ages 13 – 17 | Designed to develop financially responsible teens while helping them save for the future.